If you’re searching terms like “finance broker near me”, you’ll know that finding the right broker to help you secure a mortgage or loan can be overwhelming. Whether you’re purchasing your first home, refinancing or investing in property, working with an experienced broker can help you navigate the complexities of the financial world. But with so many brokers available, how do you choose the right mortgage broker in Melbourne? AUSUN Finance will walk you through the key qualities to look for, how to compare brokers and why local expertise is essential.

If you’re searching terms like “finance broker near me”, you’ll know that finding the right broker to help you secure a mortgage or loan can be overwhelming. Whether you’re purchasing your first home, refinancing or investing in property, working with an experienced broker can help you navigate the complexities of the financial world. But with so many brokers available, how do you choose the right mortgage broker in Melbourne? AUSUN Finance will walk you through the key qualities to look for, how to compare brokers and why local expertise is essential.

Key Qualities to Look for in a Finance Broker

Not all brokers offer the same level of service, so it’s important to assess their credentials before making a decision. Here are some key qualities to consider:

Experience & Industry Knowledge

A good mortgage broker should have years of industry experience and an in-depth understanding of various loan products. AUSUN Finance has extensive knowledge of Melbourne’s property market and a strong network of lenders, ensuring clients receive financial solutions that suit their needs.

Customer Reviews & Reputation

Before selecting a finance broker, check online reviews and client testimonials. Positive feedback from previous clients indicates trustworthiness and efficiency. A well-reviewed broker will have a track record of helping borrowers secure home loans and achieve their financial goals.

Range of Services

A mortgage broker should offer comprehensive financial services beyond just home loans. A broker with a broad service offering can tailor solutions to different financial needs. At AUSUN Finance, we can provide assistance with residential and commercial loans, SMSF loans and refinancing.

How to Compare Brokers Effectively

When searching for the right mortgage broker in Melbourne, take the following steps to compare your options:

- Consult Multiple Brokers – Don’t settle for the first broker you find. Schedule meetings with various brokers to compare their loan products, interest rates and level of service.

- Assess Communication & Transparency – A good broker should be clear about fees, commissions and loan details. They should answer your questions thoroughly and provide step-by-step guidance.

- Check Their Lender Network – The more lenders a broker works with, the better your chances of securing a competitive loan rate. A broker with strong lender relationships like AUSUN Finance can offer more tailored loan options.

Why Local Expertise Matters

Choosing a finance broker that understands the Melbourne market is important. Local brokers have strong ties with lenders and an in-depth knowledge of the region’s property values and lending conditions. This expertise ensures they’ll find the most suitable loan products that are tailored to your specific needs.

Contact AUSUN Finance Today

If you’re wondering “where can I find a mortgage broker near me?”, look no further than AUSUN Finance. With years of experience, strong lender relationships and a client-first approach, we can provide customised financial solutions tailored to your needs. Contact us today to discuss your goals.

Related Blog

July 21, 2025

Short-Term Property Loans: A Guide for Melbourne InvestorsFor many investors in Melbourne, short-term property loans offer the flexibility needed to act quickly, whether you're flipping a house, covering a temporary funding gap or securing a property before .....

July 21, 2025

How to Choose the Right Loan Broker for Your NeedsFinding the right loan broker can make a significant difference in your financial journey, whether you're applying for your first home loan, refinancing or navigating SMSF lending. If you’re searchi.....

June 27, 2025

Finding the Best Mortgage Broker in MelbourneWhether it's buying your first home, refinancing or expanding your investment portfolio, it’s natural to search for a "mortgage broker near me". But not just any broker will do. You want someone who.....

June 27, 2025

Top 5 Reasons to Refinance Your Home Loan in MelbourneThinking about refinancing your mortgage? You’re not alone. Many homeowners choose to refinance their home loan in Melbourne to take advantage of better interest rates, enjoy more flexible loan term.....

May 26, 2025

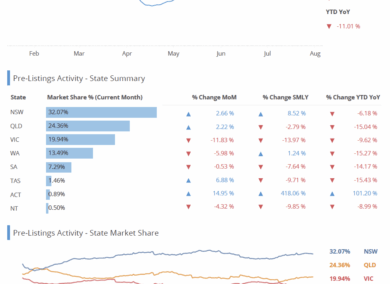

Melbourne’s Property Market Trends: What it Means for Your MortgageMelbourne’s property market has seen significant shifts in recent months, with changing interest rates, buyer sentiment and housing supply all playing a role in shaping current conditions. For borro.....

May 26, 2025

Refinancing Your Home Loan: Common Myths DebunkedWhen it comes to managing your mortgage, refinancing can be one of the smartest financial moves you make. However, many homeowners hesitate due to common misconceptions. At AUSUN Finance, we believe i.....

April 30, 2025

SMSF Loans Explained: How to Invest in Property with Your SuperannuationSelf-managed super funds are a popular way for Australians to take control of their retirement savings. One of the standout strategies SMSFs offer is the ability to invest in property using an SMSF lo.....

April 30, 2025

Mortgage Broker vs. Bank: Which is Better for Your Home Loan?When it comes to securing a home loan, one of the first decisions you’ll need to make is whether to go through a mortgage broker or deal directly with a bank. Both options can help you finance your .....

March 31, 2025

Why Choose a Melbourne-Based Mortgage Broker for Your Home Loan?Buying a home is one of the most significant financial decisions you’ll make, and navigating Melbourne’s dynamic property market can be challenging. That’s why working with mortgage brokers in M.....

September 04, 2020

教你几招 -> 如何尽早还清贷款滴水成河,粒米成箩,从年轻的时候开始慢慢积累财富,安享晚年这是许多人的规划。那么我们怎么能更快的还清贷款呢? 今天跟大�.....

August 28, 2020

如何通过分析一份流水判断贷款的成功率银行流水会透露出一个人的生活习惯,消费习性,甚至能判断出你经常去的场所,是否单身,爱好等等。今天带着大家一起分析下流水中那些.....

August 21, 2020

开发商准备屯地时,需要做些什么呢?疫情一波未平一波又起,全球感染人数已经突破2000多万人。全球经济大面积停摆,第二季度GDP极度下挫,大部分行业都收到了影响,很明显�.....

August 14, 2020

准备抄底房市,你需要做什么准备受到COVID 19 第二波的影响,维州重新进入stage 4,大部分行业受到影响,房价也出现了下滑,很多人都开始准备抄底房市,今天我们就来聊聊抄底房市.....

July 31, 2020

Break costs – break or not? This is a question!联邦银行多次的降息把贷款利率带到了历史最低点。许多人在考虑要不要退出现有的固定利率从而可以选择更低的利率, 其中考虑的重.....

July 03, 2020

澳洲购房,银行贷款预批(pre-approval)有多重要!预批是银行针对贷款人的一个初步评估,通过对其偿还贷款能力的分析,给出一个可用于购房的预估的贷款额度。今天小课堂就聊一�.....

June 26, 2020

Living Expense成为贷款申请中的“黑天鹅”?作为贷款申请中很重要的一部分,生活费会在很大程度上影响我们的贷款金额。在Royal Commission监管下,银行会使用HEM(Household Expenditu.....

June 05, 2020

购买75万以下房产所有福利(包括首次置业所有福利)如果你打算购买75万以下物业,如果你是首次置业,如果你想拿到所有的福利,如果你有10分钟,那么我们就开始吧。 尽管�.....

May 15, 2020

固定利率真的是固定不变的吗? – 利率锁定 (Rate Lock)固定? 锁定? 傻傻分不清楚! 既然都选择了固定利率, 为什么还要锁定呢? 今天我们就来帮大家解答这个问题。 在选择�.....

May 08, 2020

LAND BANKING中你不知道的那些事儿近期,有许多开发商在囤地;银行和基金机构将这一系列的囤地行为统称为“Land Holding”。Land Banking是一种资本博弈的游戏,也是开发过程中.....

April 24, 2020

没有败给疫情,却被现金流拖垮?教你如何绝地逢生疫情期间,现金为王。如何在险象迭生的疫情期间绝地逢生?我们总结了一些方法提高现金流,降低还款压力,帮助大家安全渡过这�.....

March 26, 2020

冠状病毒中小企业担保计划延续上一期特刊《手把手教你:疫情期间四大银行延期还款指南》,我说过最近会着手研究《冠状病毒中小企业担保计划》Coronavirus SME Guarante.....

March 23, 2020

手把手教你:疫情期间四大银行延期还款指南继上周五本公司Nick Li所写的AUSUN小课堂101期《疫情期间澳洲各银行支援政策指南》后,本公司收到大量的咨询电话,邮件和微信,基�.....

March 13, 2020

RBA降息之后,你到底有没有少还贷款?日前央行下调 cash rate 至澳洲有史以来最低点0.5%,然而大部分人并不清楚,下调基础利率对自己的贷款有着什么样的影响,今天我们�.....

March 06, 2020

作为父母,如何更好的帮自己的成年孩子购买房产每一个华人都有置业的想法,每一个华人父母都希望自己的孩子可以早早的拥有自己的房产,那我们如何帮助他们早日买到呢? &nbs.....

February 28, 2020

商业物业贷款如何才能拿到3%的利率在小课堂第91期《三种方法帮你商业物业贷款100%》,我们讨论了商业物业如何来做到100%贷款,让你有更多的现金流。那么今天我们来讨论一�.....

February 21, 2020

Thomas 居然连成功人士也交了智商税—为什么房子会低估(下)主笔简介: Thomas澳洲小火车,汤继允。AUSUN Finance合伙人之一,MFAA维州五佳贷款经纪人(2019),全国排名前100贷款经纪人,原墨尔本银行最佳.....

February 14, 2020

居然连成功人士也交了智商税—为什么房子会低估(上)主笔简介: Thomas澳洲小火车,汤继允。AUSUN Finance合伙人之一,MFAA维州五佳贷款经纪人(2019),全国排名前100贷款经纪人,原墨尔本银行最佳.....

February 07, 2020

AUSUN FINANCE四获小钢炮版权所有。未经AUSUN Finance书面许可,不得翻印、复制或以任何方式再次使用本文任何内容。我们保留随时更改�.....

January 24, 2020

2020新年贷款返现派钱大优惠2020澳盛金融新年特供优惠,你还在等什么? Westpac-单个物业转贷返现 $2,000* 适用于2020年04月30日前递交转贷申请,并于2020年06月30日�.....

January 17, 2020

Ready or not, FHLDS is here!书接AUSUN Finance小课堂第87期, 5%首付贷款政策(FHLDS)在大家庆祝新年的欢歌笑语中正式开始执行了。 这一期就继续跟大家聊一下这个新�.....

January 10, 2020

注意!那些你所不在意的生活开销正在吞噬你的借贷能力!在AUSUN Finance 小课堂的第82和90期,我们聊了关于不同收入形式对贷款审批的不同影响,今天咱们就来聊下生活开销对贷款额度以及审�.....

November 22, 2019

银行如何计算收入(下篇-self-employed)在澳盛金融小课堂第82期我们聊了银行对于PAYG(受雇)形式收入的使用和认定,本期我们会针对银行对于Self-employed(自雇)的使用和认定�.....

November 15, 2019

国际化贷款业务专家–Junhao Sun“AUSUN Finance董事长兼创始人Junhao Sun以他的经历告诉澳大利亚经纪人,他如何在短短5年的时间内,利用文化优势,打造多元化业务,雕刻出属于�.....

November 01, 2019

5%首付政策来了, 您准备好了吗?让所有首次购房者翘首以盼的5%首付政策终于在这周出炉了新的细节, 今天我们就来谈谈这个新政策的来龙去脉和具体实施方法。 &nb.....

October 25, 2019

一个好的Broker在贷款变得“容易”的状况下多重要?澳洲目前历史新低的利息政策下,是否意味着贷款也变得更加容易?今天我们就来聊一聊这个话题。 Continue reading 一个�.....

October 18, 2019

First Home Buyer的福利小编在做贷款咨询的时候常常会被问到以下一些问题,我是否有资格拿首次购房补助? 我是否能有印花税的减免?我应该交多少的印花税�.....

October 11, 2019

购买投资房的9个tips购买投资房已经成为澳洲一种主流的投资方式。然而购买投资房时需要注意什么,今天就分享九个tips给大家。Continue reading 购买投资房的9个tips.....

October 07, 2019

只用3秒钟,你就可以算出自己的贷款能力星期二澳联储又降息25个基准点,又创造了澳洲历史最低利率,很多朋友可能会想咨询一下自己目前的贷款能力怎么样,对于之后的投资策.....

September 30, 2019

银行如何计算收入(上篇-PAYG)?今天我们来聊一下不同的收入,让大家了解哪些收入是银行可以接受,同时也让大家清楚银行会按怎样的比例来计算这些收入。本篇文章只针对�.....

September 26, 2019

过桥贷款, 先买后卖?房子不是你说卖, 想卖就能卖. 那如果想买新房, 旧房还没卖怎么办呢? 过桥贷款可能是一个不错的选择. Continue reading 过�.....

September 26, 2019

25年墨尔本房产市场总结和未来趋势在过去的二十五年里,墨尔本的房价以平均每年 8.1%的速度在增长,并且其中有七年是涨幅收益率超过10%的。最近,墨尔本房地产市场一直处�.....

August 09, 2019

一个60万的投资房如何省税?在回答这个问题之前,我们先说一下负扣税 – Negative Gearing。在我们买投资房的时候有一个经常会涉及到的话题就是负扣税。 负扣税是什么,负.....

August 04, 2019

关于最近贷款政策的一些更新及问题解答本文会剖析一下关于近期银行降息以及assessment rate 下调的一系列动向,并解答最近客户经常咨询的一些问题,让大家对贷款市场的变化有一些认.....

June 21, 2019

贷款政策放松的预兆 – 绝对的大事件!随着大选的尘埃落定,6月澳洲央行刚刚降息25个基准点,上周清空率的回升,大家都在讨论的话题就是是不是银行要放松贷款政策? Continue readi.....

June 21, 2019

你要在维州买房吗? 你知道房产印花税吗?这篇文章会覆盖以下9个点: 1. 如果您想了解如何计算维多利亚印花税, 2. 维多利亚州的印花税的重要事项 3. 购房者的更多优惠。 4. 首�.....

June 07, 2019

AUSUN Finance 办公室搬迁通知喜大普奔,欢迎做客!AUSUN Finance搬家啦~ Continue reading AUSUN Finance 办公室搬迁通知.....

May 31, 2019

转贷季,返现无上限!各大银行转贷款优惠还在继续,6月30日前转贷,有机会获得单套最高总价$3,500的现金反现,多套无上限! 欢迎联系咨询详情。 Continue reading 转贷�.....

May 10, 2019

建筑贷款的利息如何计算建筑款与一般的房贷不同,并不是在交割的时候银行一次性把所有的贷款额全部给客人,而是在每次Progress Payment的时候放款。利息的计算�.....

May 03, 2019

Refinance低利息中的“陷阱”—银行连员工都不教的秘密有一种谎言,叫沉默。 Refinance,也就是我们俗称的“换一家银行,利息更低一些。” Continue reading Refinance低利息中的“陷阱”—银行连员工.....

April 26, 2019

最近银行利率变动的整理和解析日升日落, 潮涨潮汐. 于我们生活息息相关的贷款利率也逃不过自然的规律, 有涨就有降. 涨时心惊肉跳, 降后心花怒放. 今天就来跟大家分享下最�.....

April 12, 2019

捆绑抵押物还是独立抵押物?常常会被客户问到这样一个问题,我是应该将我所有房屋贷款捆绑在一起,还是应该每一个房屋贷款都是独立的? Continue reading 捆绑抵押�.....

April 05, 2019

The way banks determine your outgoing expendituresOver the past 5 years, banks have been steadily lending out less and less compared to previous years. There has been lots of discussion out on the media and in the market about the crack down on bank�.....

March 29, 2019

所有银行都不给养老金贷款!!!最近麦格理银行(Macquarie) 公布说,停止了自管养老金(SMSF)贷款这项服务,换而言之,现在澳洲所有得银行都停止了SMSF的借贷。主要原因是之�.....

March 22, 2019

如何一击即中,避免在多家银行重复申请大家在申请贷款的时候通常会比较哪家银行的产品利率更好,功能更多等等。但是面对市场上五花八门各种各样不同的银行,怎么样才能一击即�.....

March 15, 2019

转贷返现最高$2000, 倒数15天!各大银行转贷款优惠还在继续,最后2周的时间。3月31日前转贷,有机会获得最高总价$3,500的现金反馈。同时抓紧机会锁定低固定利率,欢迎联系.....

March 08, 2019

购房时可能遇到的法律小知识:Caveat (警告通知)任何对某房产具有合法权益的人都可以申请在Land Use Victoria上登记一个Caveat。一旦Caveat被顺利登记,该房产的地契上就会出现一条警告信息,让�.....

February 22, 2019

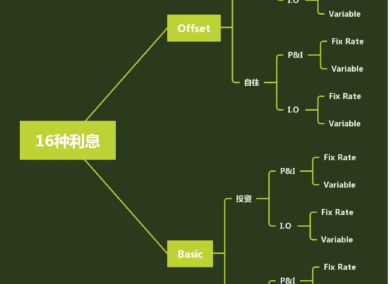

为什么大家的利息不一样?银行的16种利息,16种坑!作为客人,我们在准备办理住房贷款的时候首要关注的是银行的利息。澳洲银行针对客人的不同需求设定了16种利息,而低利息的产品往往是客�.....

February 15, 2019

您知道自己的信用评分是多少吗?在之前的文章中我们AUSUN Finance为您讲解了综合信用报告(请参看2018年9月14号的文章), 对于信用报告中的信用评分您又了解多少呢? 正好最近.....

February 01, 2019

再获殊荣,小钢炮奖再落AUSUN Finance人们都说,同一个弹坑里不会落下两颗炮弹,然而事实证明并不是。今年MPA YOUNG GUNS 2019(小钢炮奖)再次由AUSUN Finance (澳盛金融)的Neo Huo获得�.....

January 25, 2019

SMSF 商业贷款 2019自2007年9月开始,政府允许SMSF通过无追索权的贷款(limited recourse loan)进行投资。无追索权贷款指当SMSF无力偿还贷款时,银行或贷方无权追索抵押物之�.....

January 18, 2019

在购买第二套房产时如何最大化您的贷款能力很多朋友在购买了自住房之后的2到3年中,可能有计划会要购置投资房,一来,手中持有房产可以静待升值,二来由于负扣税的原因可能在税务�.....

December 07, 2018

《澳央行保持现金利率第28个月不变》澳大利亚央行在其2018年的最后一次会议上保留了现有官方现金利率,这将继续刷新澳大利亚央行保持现金利率不变的记录。Continue reading 《澳央�.....

November 16, 2018

贷款的正确期待值和时间流程2018年还剩5周。许多准备年内购房并办理贷款的朋友应该注意什么?贷款办理流程大致是什么样的?每个流程预计花费多少时间?签订购房合同�.....

November 09, 2018

银行贷款专业套餐产品详解相信许多办理过贷款申请的朋友在申请贷款时都会有这样的疑问, 什么是专业套餐产品?它有什么好处?为什么要选择套餐产品? 今天澳盛金�.....

November 02, 2018

澳洲财政预算分析:对房地产买家和卖家的影响2017年预算案主要侧重于住房供应和可负担性。今年,住房退居二线,对于首次购房者或租房者没有新的直接措施,但是一些变化可能会对住宅和商业�.....

October 26, 2018

养老金贷款你要知道的坑 – 流动性要求自管养老金(SMSF)贷款现在已经被很多人所熟识,因为他的特点非常的明显,如果目前您名下已经有太多的贷款,可以用养老金来购买额外的投资物业或�.....

October 18, 2018

汽车贷款政策与常见误区有房有车,是许多新老华人移民来到澳洲后便要置办的两样东西。而且通常也是一个家庭中比较贵的两样东西。每期公众号中提了很多房贷的内容,这�.....

October 11, 2018

澳洲地产真的不好了吗?上帝给你关上门,必然会给你开一扇窗。今天和大家分享一下在澳财网采访的内容文稿分享。不是市场不好了,而是方向在调整。澳洲政府这两年一直在调控的地产市场,放缓地产投资增速,�.....

September 27, 2018

House & Land贷款申请详解在澳洲购买房产时,大家有时会倾向买House & Land package或者买地自己建房,因为这样有可能可以得到印花税的一定减免,并且在购房的支出上可能也.....

September 20, 2018

2018下半年房贷返现及优惠攻略澳盛金融特供优惠,仅限两周9月30日前转贷,有机会同时获得$1250现金反馈➕最多高达500,000 Velocity Points!价值约等五千澳币,可换取一家四口美国往返�.....

September 14, 2018

综合信用报告 Comprehensive Credit Report自2018年9月起,您的信用报告中将包含更多信息。相信大家都想了解这对您的财务状况有着什么样的影响。Continue reading 综合信用报告 Comprehensive .....

September 06, 2018

要有多少收入才能在墨尔本买第一套房?随着价格的增长速度远胜于储蓄的速度,想拥有一套属于自己的房子成为了许多年轻买家遥不可及的梦想。 过去一年,想在墨尔本买房的首次�.....

August 30, 2018

西太平洋银行(Westpac)提高住房贷款的浮动利率就在这周三,澳洲四大银行之一的Westpac宣布将会提高其住房贷款的浮动利率。Westpac涨息已经是铁板钉钉的事实了,相信现在大家关心的是其他�.....

August 17, 2018

专业人士90%房屋贷款(免LMI)您知道吗?一些特定的专业人士是可以申请90%的房屋贷款却又可以享有免支付LMI保险费的优惠的! 一般来说银行要求借款人一旦贷款超过80%.....

July 20, 2018

House& Land Package 购地建房套餐解析[blockquote]在澳洲,买地建房(House and Land Packgage)是一个渐受欢迎的投资策略,基本操作是先买下一块土地,再设计建房,好处是能利用土地带来的升值.....

July 13, 2018

有条件贷款预批 Pre-approval什么是有条件贷款预批? 有条件贷款预批即为放贷机构表明您有资格申请到一定额度的住房贷款。放贷机构会根据您的财务状况,想要购买房产的区域�.....